Advertisement Headline

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

A home purchase is one of the largest financial commitments you’ll make, but it’s well worth the investment. Though your income, savings and debt-to-income ratio all factor into the mortgage approval process, one number carries more influence over all others: your credit score.

By comparing your credit score and history with a set of criteria, lenders evaluate how financially reliable you are as well as how risky it would be for them to lend you money. A high score can result in improved mortgage terms, while a low one could limit your options — or even block approval altogether.

This article takes a look at why credit scores matter, what lenders are looking for and how you can prepare before applying for a mortgage.

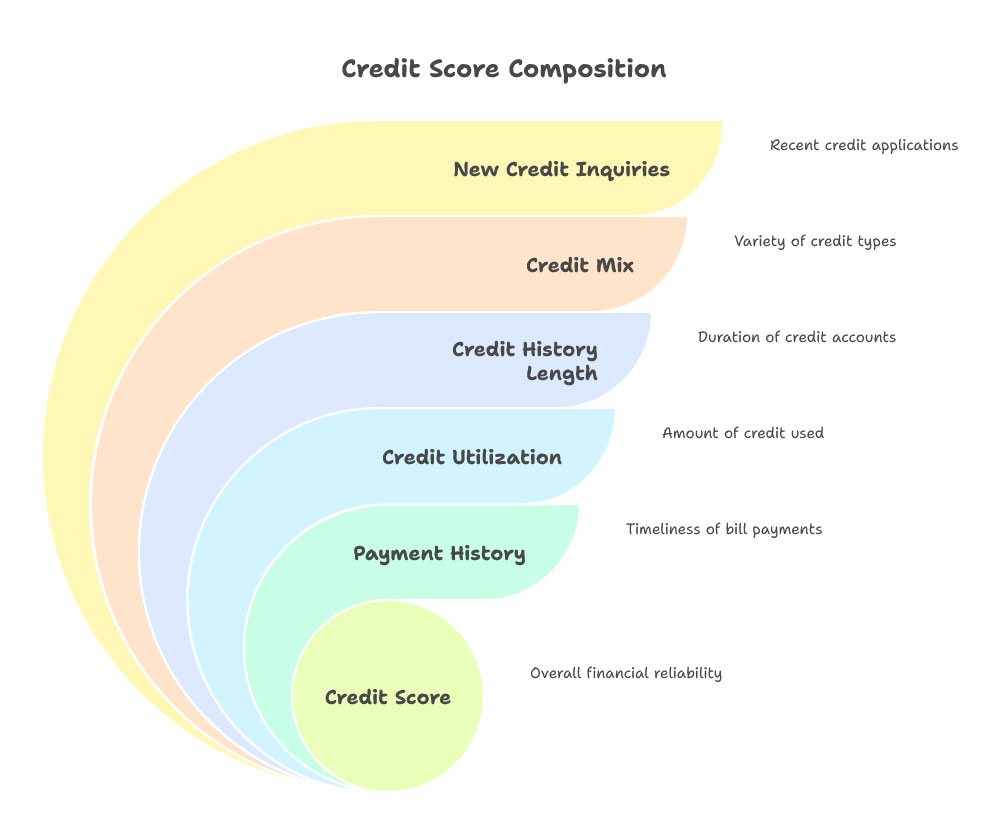

A credit score, generally a three-digit number from 300 to 850, is an observation of your credit history. It is calculated based on things like:

The higher your score, the more financially reliable you seem to lenders.

When you take out a mortgage, lenders want to reduce their risk. Your credit score provides them with a snapshot of how highly you are likely to repay the loan. Here is how it affects the process:

Though each lender has its own requirements, here’s a general guideline:

Now consider two buyers, both of whom seek to take out a $300,000 mortgage:

That 1% might sound minuscule, but when compounded over 30 years, it can translate to tens of thousands of dollars more in interest.

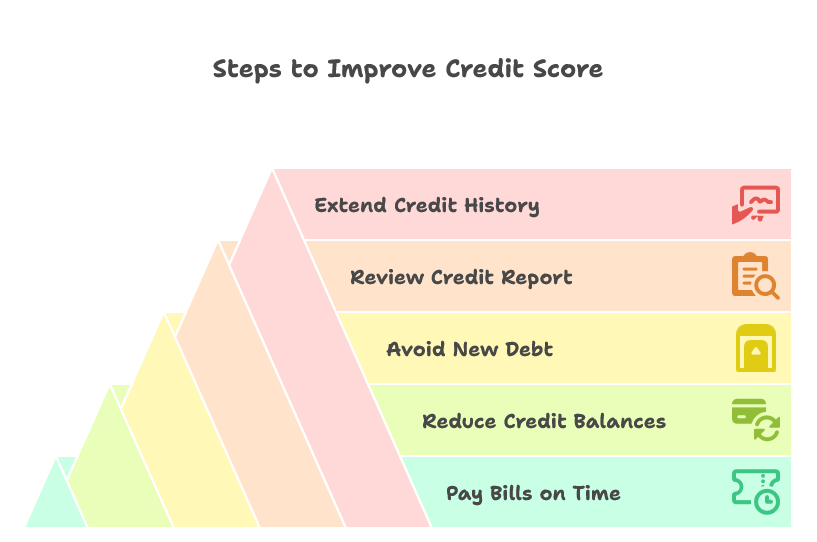

If your score isn’t what you’d like it to be, not to fret — there are things you can do to shore up those scores:

A small increase in your score could mean big savings in mortgage options.

Your credit score is more than just a number — it’s the golden key that unlocks the doors of how you own your home. A better score could mean better odds of credit approval, lower interest rates and thousands of dollars saved.

At Monalending, we assist homebuyers with deciphering their credit profile and analyzing the mortgage programs that would best match their self-indulgence. Whether you have a great, good or bad credit score, our staff is here to help you through the entire process!

Thinking about buying a home? Today is the day to find out if you don’t believe you can qualify for a mortgage or want to know how much home you can afford.

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

For many of us, purchasing a home will be the single most important investment decision we will ever…

Purchasing your first home is a big deal — but all that excitement can feel daunting if you…

For the vast majority of people, home ownership represents the single biggest purchase they’ll ever make. While you…

We are an Equal Housing Lender. we do business in accordance with the Federal Fair Housing Law and the Equal Credit Opportunity Act.