Advertisement Headline

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

For many of us, purchasing a home will be the single most important investment decision we will ever make. With all the different types of mortgages, interest rates and lenders out there, the options may seem infinite. Enter the mortgage broker. But what is a mortgage broker and how can they help make the path to homeownership easier and cheaper?

In this piece, we’ll dissect what a mortgage broker does, how they stack up against the big banks and how they can help you save time, money and hassle as a borrower.

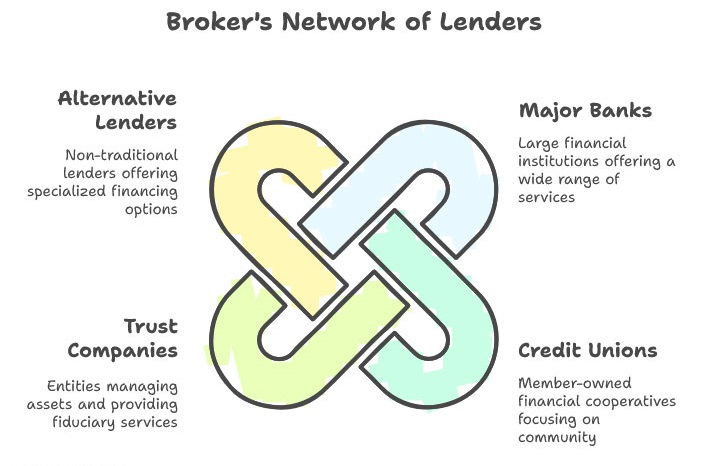

A mortgage broker is an intermediary who can lend on your behalf and also shop around for loans at various lenders. A broker doesn’t work for any one bank, but has a network of lenders at their disposal – these include:

Which means that the broker’s main job is to shop your deal on your behalf, and find the mortgage product that suits you best.

Think about your local bank; when you visit the branch, all it can offer as far as mortgage products are those that the actual bank supplies. This is all easy, but it potentially restricts your options.

What about a mortgage broker:

In brief: banks sell their own products; brokers compare the entire market for you.

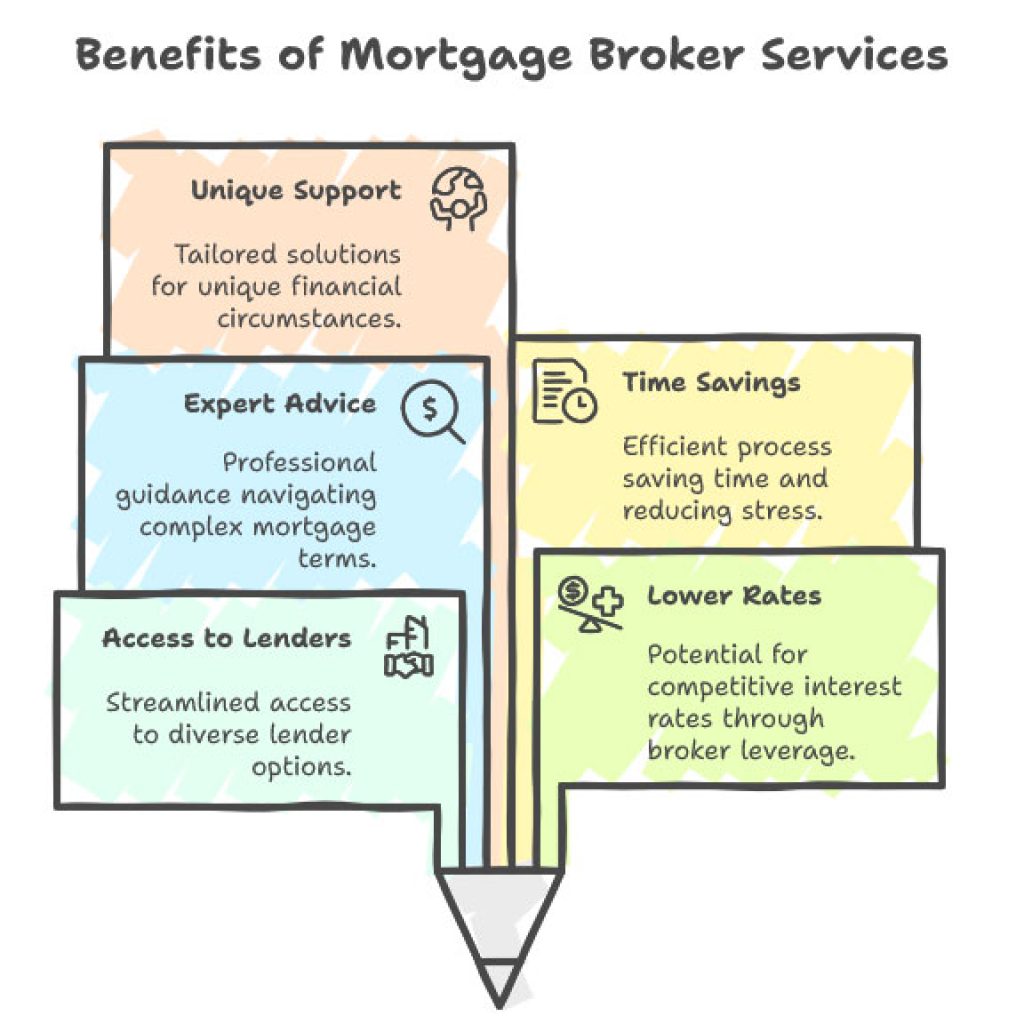

Instead of going to multiple banks individually, one broker does the legwork. They will provide you with personalized options from multiple lenders, and help you compare to see which lender is best for your needs.

Because they bring in significant amounts of business, brokers often have leverage with lenders. That could mean more competitive interest rates than you would receive on your own.

Mortgages are complicated. There are so many things to consider, from fixed versus variable rates to term length and prepayment penalties. A broker helps you figure out your options and steers you away from expensive blunders.

Instead of looking around and applying for multiple loans, you submit the details once. The broker does the comparison shopping, paperwork and back-and-forth with lenders.

There are plenty of people out there for whom “traditional borrower” doesn’t apply. If you’re self-employed, have bruised credit or need a niche product, brokers can match you with alternative lenders that offer more flexible products.

For the most part, no. Mortgage brokers are generally paid a commission by the lender when your home loan is concluded. Their services don’t cost most borrowers anything out of pocket.

The exceptions are more complex cases, like a private lender that might charge a tiny fee — “but we always talk about it upfront.”

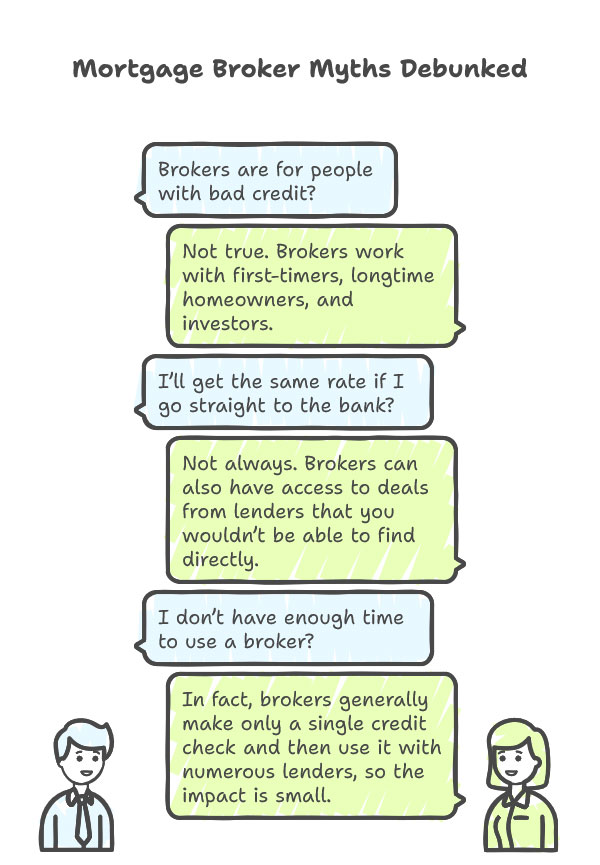

Not true. Brokers work with first-timers, longtime homeowners and investors.

Not always. Brokers can also have access to deals from lenders that you wouldn’t be able to find directly.

In fact, brokers generally make only a single credit check and then use it with numerous lenders, so the impact is small.

A mortgage broker is more than a middleman — they are your advocate in one of life’s biggest financial transactions. By providing you with access to multiple lenders, finding you the best rates and streamlining the process, a broker can help get you not just approved for your mortgage, but also save money over the life of it.

If you’re purchasing your first home, refinancing or renewing, a mortgage broker can make the entire experience seamless and painless.

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

For many of us, purchasing a home will be the single most important investment decision we will ever…

Purchasing your first home is a big deal — but all that excitement can feel daunting if you…

For the vast majority of people, home ownership represents the single biggest purchase they’ll ever make. While you…

We are an Equal Housing Lender. we do business in accordance with the Federal Fair Housing Law and the Equal Credit Opportunity Act.