Advertisement Headline

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

“Whoa, how much down payment do I need to buy a house?” When it’s time to start thinking about purchasing a home, one of the first questions many buyers have is: “Come again? How much do I need for a down payment?” For a lot of first-time buyers, the prospect of saving tens of thousands of dollars is intimidating. But, in reality, there’s no such thing as a one-size-fits-all down payment — plus the facts vary from person to person based on factors like financial history and long-term goals.

In this guide, we break down what a down payment actually is, why it matters, and how much you might need in the bank to buy your new home.

A down payment is your initial payout for a home when you buy it. It is expressed as a percentage of the home’s purchase price and reflects your own financial investment in the property. For instance, if you are buying a $300,000 home and you make a 10% percent down payment ($30,000), with a mortgage of 90%, or $270,000.

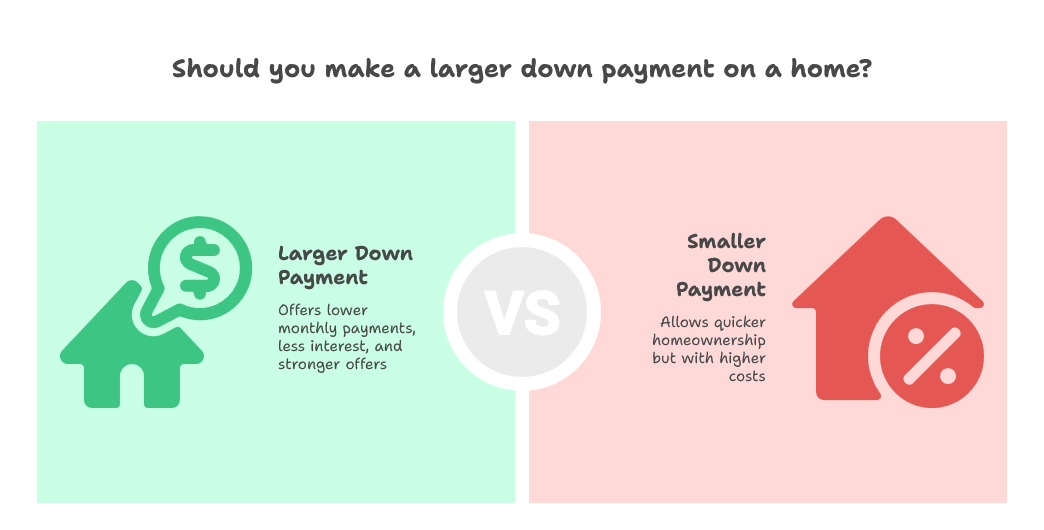

The more money you can put down, the less you’ll need to borrow — and that can affect your monthly mortgage payment, interest rate if you qualify for a loan.

You may have heard the “20% down” rule. In the past, lenders generally wanted buyers to put down at least 20% upfront. There are good reasons for doing this:

But here’s the thing: You don’t need 20 percent. Current mortgage programs allow more people to participate in the joy of homeownership with a small down payment.

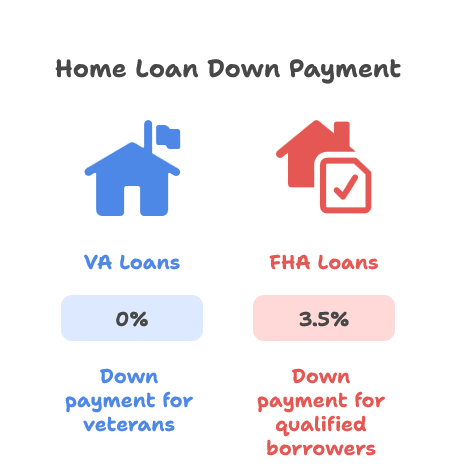

You could pay less to buy a home than you would for rent Depending on the cost of the home and how much you are able to put down, it is often possible to get into a home with very little cash. Here are some common options:

That means you may need to bring $0 up to $10,500 on a loan program for a $300,000 house.

While you can buy a home with a smaller down payment, there are benefits to saving more if you’re able:

A common mistake that many buyers make is using all their savings on the down payment. Remember, you’ll need money for:

A smaller down payment might be acceptable if it helps keep your finances in good shape after closing.

There is no single “right answer” — it depends on your financial goals, income and the type of mortgage you’re seeking. To try to figure out what’s best for you, ask yourself these questions:

A down payment of 3–5% is a benefit to some buyers who now become homeowners sooner. For others, being closer to 20% saves them peace of mind and long-term savings.

If you’re still saving up for your down payment, here’s what you can do:

It is okay to spend the money, after all it is a gift and it should be put to good use.

A down payment doesn’t need to be a scary roadblock. The 20% down loan has many benefits, but most of today’s new programs allow a minimum down payment and much more flexibility. The trick is knowing your options and finding the right balance between your down payment and your overall financial health.

At Monalending, we’re here to navigate you through the process from finding out which loan program is right for you, to crafting a down payment plan that best fits with your budget and long-term plans.

Ready to step into your beautiful new home? Reach out to us today so we can discuss what potential options you have and how best to proceed in your situation.

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

For many of us, purchasing a home will be the single most important investment decision we will ever…

Purchasing your first home is a big deal — but all that excitement can feel daunting if you…

For the vast majority of people, home ownership represents the single biggest purchase they’ll ever make. While you…

We are an Equal Housing Lender. we do business in accordance with the Federal Fair Housing Law and the Equal Credit Opportunity Act.