Advertisement Headline

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

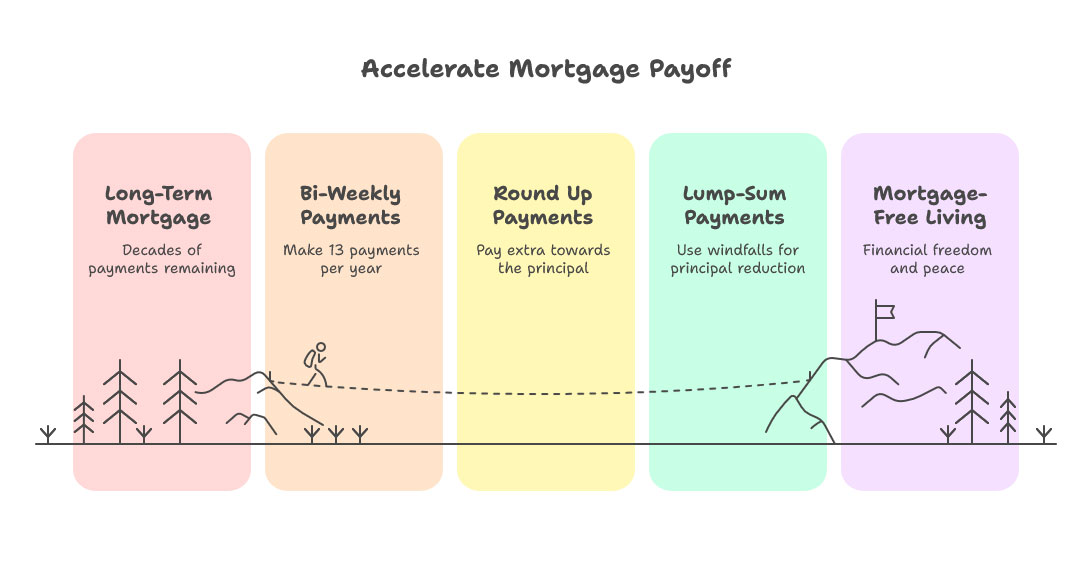

For the majority of homeowners, their mortgage is the largest financial commitment they will ever make. The traditional mortgage term may span decades, but you don’t have to wait 25 or even 30 years to be mortgage-free. By planning smart and having discipline, you can pay off your mortgage a lot faster — saving up to tens of thousands of dollars in interest and freeing yourself from financial stress long before other homeowners.

Here are some tested tactics to help you shave years off of your mortgage.

Most homeowners pay 12 installments per year. But if you begin making bi-weekly payments, each year you’ll actually make 26 half-payments — which makes 13 full payments instead of 12.

That one extra payment per year can shave years off your mortgage and save thousands in interest.

Rounding up is one of the easiest ways you can pay off your mortgage faster. For instance, if your payment is $1,237, try to pay $1,300. That small additional amount goes directly to your principal, and helps you pay down your balance more quickly.

With many of these loans, prepayments — additional lump-sum payments toward your principal — are penalty-free. Use a tax refund, work bonus or some other sort of windfall to make periodic large payments. Even making one or two lump-sum payments can drastically shorten your mortgage term.

If you can afford more per month, consider refinancing into a shorter mortgage term (like 15 or 20 years, instead of 30) to save tens of thousands in interest. Shorter terms often contain lower interest rates as well, which means you could be on the road to mortgage freedom quicker.

Raises, side hustle money or overtime pay can so quickly fall away if you don’t get thoughtfully aggressive. Use that extra cash to pay down your mortgage instead. Every dollar that you pay early translates into lower interest fees.

And some lenders allow you to skip a payment or extend your amortization when the money is tight. While this offers short-term relief, it lengthens your mortgage term and raises total interest costs. If the plan is to accelerate payment, avoid these methods at all cost.

After refinancing into a lower interest rate, don’t touch your monthly payment. Just keep paying what you’re used to. More is applied to the principal and thus, you pay off the loan more quickly.

High-interest debt, such as that associated with credit cards, can stand between your mortgage payoff goals. Focus on paying the debts off first so that you can then move more money toward your mortgage without overstretching yourself.

Example: How Making Some Extra Payments Can Help You Save

Say you have a $300,000 mortgage with a 6% interest rate and a 30-year term.

Little tweaks can have a big effect.

You don’t need to make huge sacrifices in order to pay off your mortgage early—it’s about making strategic, consistent moves over time. By paying more each month and through the life of the loan, refinancing strategically or using a mortgage with prepayment options, you can rack up equity faster and save a ton on interest.

At Monalending, we assist individuals on independent home mortgage planning. If you’re looking to refinance, change your payment schedule or simply beat the mortgage break penalty offered by your lender, we can walk you through it.

Eager to fast-track your way to mortgage-free living? Get in touch with Monalending now to find out how you can pay off your mortgage quicker and save thousands while doing so.

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

For many of us, purchasing a home will be the single most important investment decision we will ever…

Purchasing your first home is a big deal — but all that excitement can feel daunting if you…

For the vast majority of people, home ownership represents the single biggest purchase they’ll ever make. While you…

We are an Equal Housing Lender. we do business in accordance with the Federal Fair Housing Law and the Equal Credit Opportunity Act.