Advertisement Headline

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

If you’re a homeowner, you may be staring down one important question: To renew or refinance your mortgage? Though the two words are often used interchangeably, they mean quite different things — and the term you embrace could greatly affect your finances.

In this piece, we’ll dissect the difference between mortgage renewal and refinancing, the pros and cons of both, and how to figure out which one is right for you.

A mortgage renewal is when your term comes to an end and yet you have a balance remaining. Rather than paying off the entire loan, you just “renew” it for another term — typically with the same lender.

During renewal, you can:

Example:

If you have a 5 year mortgage term and your loan is no where near paid in full at the end of 5 years, you will need to renew your mortgage for another 5 years (or whatever term length) until the loan is fully paid.

Key Point: Renewal allows you to stay with your current mortgage (usually under updated terms).

Refinancing is when you replace a mortgage with a similar product, ideally one that gives you better terms or fits your budget more effectively — it could come from the original lender or a new one. It’s essentially starting fresh.

Example:

If you’ve got 20 years remaining on your current loan but you’re eyeing lower rates, consider refinancing into a new 20-year mortgage — or chop three more years off your term and refinance into a 15-year loan to retire that home debt even sooner.

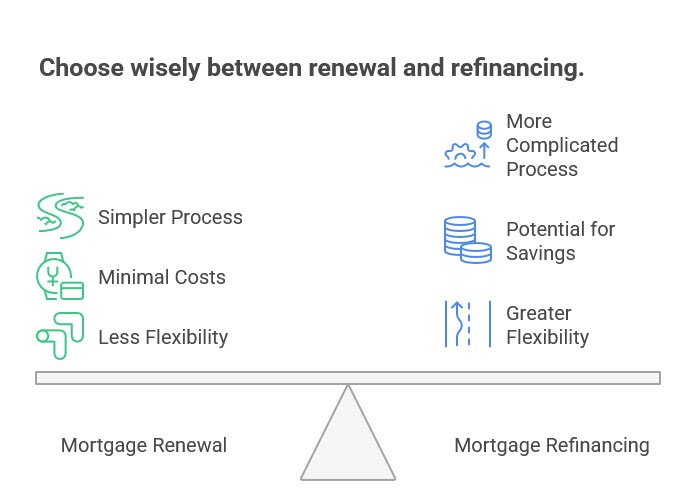

✅ Simpler process

✅ Minimal costs

✅ It could be a chance to negotiate down the rate

❌ Less flexibility than financing

✅ Potential to save a lot on interest

✅ Access to equity for renovations, debt repayment or investments

✅ Ability to switch between loan type and terms

❌ May require closing costs, penalties, or fees

❌ More complicated than renewing it

Ask yourself these questions:

Are you satisfied with your mortgage and lender? → Renewal may be best.

Do you wish to save money with a reduced rate or shift loan types? → Consider refinancing.

Do you require funds for home improvement or debt consolidation? → Refinancing (cash-out) could help.

Are you coming to the end of your term and there is no significant financial shift you need to make? → Replacing is easier and cheaper.

Mortgage renewal and refinancing both have their utility — but they are not the same. Renewal is a deal to extend the length of your mortgage, whereas refinancing is the chance to restructure your loan so it better reflects your financial needs.

At Monalending we have to ask the homeowners if it is better for them to work on a renewal or refinance. Whether you’re hoping to secure a lower rate, leverage equity or make your mortgage quick and simple, we’ve got you covered.

Ready to explore your options? Give Monalending a call to find out if refinancing or renewal is best for you.

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

For many of us, purchasing a home will be the single most important investment decision we will ever…

Purchasing your first home is a big deal — but all that excitement can feel daunting if you…

For the vast majority of people, home ownership represents the single biggest purchase they’ll ever make. While you…

We are an Equal Housing Lender. we do business in accordance with the Federal Fair Housing Law and the Equal Credit Opportunity Act.