Advertisement Headline

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

in debt to more than one source — be it credit cards, personal loans or car payments — can feel overwhelming. “High rates, multiple due dates and balances that never seem to go down are all barriers making it difficult to move forward.” That’s what mortgage refinancing is for.

When you refinance your home, you can use your equity to consolidate debt into one convenient bill – generally at an interest rate that’s a lot lower. Done right, this tactic can save you thousands of dollars and get you on the path to long-term financial security sooner.

Refinancing for debt consolidation refers to taking out a new home loan — typically with a higher balance than your existing one — to pay off high-interest debts, such as credit card bills. The new mortgage balance includes:

Instead of paying multiple bills, you pay one bill each month — your mortgage.

Here are some key advantages:

Mortgage rates are generally significantly lower than those for credit cards or personal loans. A 20% APR on a credit card balance can be refinanced into a 6% mortgage rate, saving thousands.

Rather than juggling several bills each month, you now need to pay only one creditor on a monthly basis.

Like refinancing to a longer loan, extending your mortgage term can bring down total monthly payments, leaving you with more money in your budget.

At lower interest, more of your money reduces principal rather than just paying for interest.

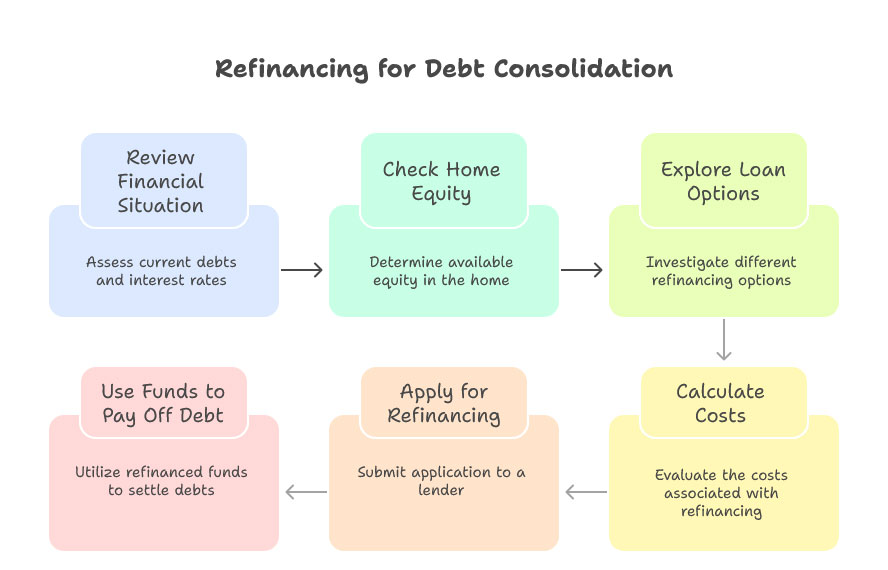

Make a list of your current debts, balances and interest rates. Then compare them to the current mortgage rates in your area to find out if you’d actually save by refinancing.

In order to cash out refinance, lenders ask you to have at least 20% equity in your home. The higher the equity, the more you can leverage to pay off debt.

Common refinancing options include:

Cash-Out Refinance –Take out more than you owe on your mortgage and use the extra to pay off debts.

Rate-and-Term Refinance: Lower your loan’s interest rate or shorten its term to lower payments (but no extra cash for debt paydown).

Refinancing isn’t free — there are closing costs you’ll have to pay, which usually fall within the 2–5% of the loan amount range. Ensure that the savings justify the costs.

You apply through a lender, submit income and asset documentation, and go through underwriting.

Refinance results Close on the refinance and then immediately use the proceeds to wipe out high-interest debts. Resist the urge to charge, otherwise you’ll end up with both a larger mortgage and new debts.

Imagine you owe:

$225,000, or a brand new loan at 6% You are able to put all of your debts into one payment. This switch will save you a lot of $$$ in interest and make the repayment much easier.

Refinancing in order to consolidate debt can be a powerful thing, but it’s not for everyone. Consider these risks:

Consolidating debt by refinancing is a savvy financial strategy– you’ll lower your interest costs, have just one monthly payment, and be more likely to take control of your indebtedness once and for all. But it takes the critical planning of a new form of discipline to succeed in the long term.

Here at Monalending we assist homeowners to review their debts and their possible savings so they can decide if refinancing is the way to go on their circumstances.

Interested in debt consolidation through refinancing?Call Monalending now for the perfect solution to all your mortgage needs.

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

For many of us, purchasing a home will be the single most important investment decision we will ever…

Purchasing your first home is a big deal — but all that excitement can feel daunting if you…

For the vast majority of people, home ownership represents the single biggest purchase they’ll ever make. While you…

We are an Equal Housing Lender. we do business in accordance with the Federal Fair Housing Law and the Equal Credit Opportunity Act.