Advertisement Headline

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

When it comes to purchasing a home, your credit score is critical to your ability to get a mortgage. It not only helps decide whether you’ll get approved but also at what interest rate, which might affect the types of loans available to you and even how much you’ll pay over the life of your loan.

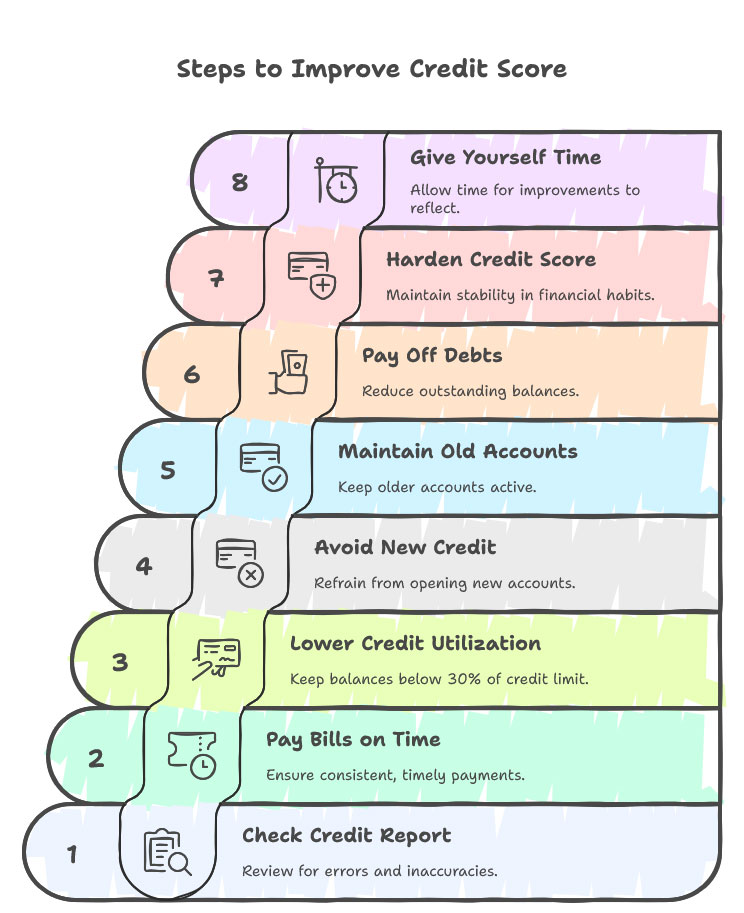

The good news? Your credit score isn’t written in stone. But you can improve — and get yourself in position for good mortgage terms. Here’s a handy guide to raising your credit score before you apply for a mortgage.

Step one is finding out where you are. Ask for a free copy of your credit report from the three leading credit bureaus: Equifax, Experian and TransUnion. Review it carefully for:

Challenging errors and getting them corrected can provide a fast improvement to your score.

Your payment history accounts for 35 percent of your credit score — by far the most significant factor. It only takes a single late payment to devastate your score.

Lenders are looking for a history of financial responsibility, so every on-time payment helps.

About 30% of your score is based on what’s known as your credit utilization ratio — the percent of available credit you use. A lower ratio tells lenders that you are credit-fiscally responsible.

For instance, if you have a credit limit of $10,000 and a balance of $4,000, your utilization is 40%. Paying it down to $2,000 drops utilization to 20%, which might help increase your score.

Any time you apply for new credit — whether it’s in the form of a credit card or loan — a hard inquiry is made and your score goes down slightly, on a temporary basis. Lenders are going to get suspicious if they have several inquiries in a short amount of time.

Don’t do these things before applying for a mortgage:

CULTIVATE: Instead, focus on growing what you have.

Your length of credit history accounts for 15% of your credit score. Closing old credit cards can reduce your available credit and shorten your credit history — two things that might ding your score.

Instead:

This is indicative of gorilla hair, a long-term credit responsible.

Also, high debt can be damaging to your credit score and can drive up your debt-to-income ratio (DTI) — an important calculation for lenders considering mortgages.

The less you owe, the better your credit score and mortgage terms.

In the months before you apply for a mortgage, do your best to:

Borrowers should be steady and stable; that’s what lenders like to see.

(You don’t fix your credit score overnight.) While some changes (such as fixing errors) might make a difference within weeks, most improvements take three to six months or longer. The sooner you start, the better situated you will be when it comes time to apply.

Your credit score is one of the most valuable things that can help you get great mortgage rates. By reviewing your report, paying bills on time, reducing debt and not applying for new credit, you can see a big change in your score and your chances of getting approved.

Here at Monalending, we help educate buyers on the mortgage process and that includes knowledge about how a credit score will impact your options. Whether you are ready to purchase today, or preparing for tomorrow, our staff is here to assist you on charting the right path.

Thinking about homeownership? Chat to Monalending today to discuss your mortgage needs and tailor a solution based on your financial situation.

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

For many of us, purchasing a home will be the single most important investment decision we will ever…

Purchasing your first home is a big deal — but all that excitement can feel daunting if you…

For the vast majority of people, home ownership represents the single biggest purchase they’ll ever make. While you…

We are an Equal Housing Lender. we do business in accordance with the Federal Fair Housing Law and the Equal Credit Opportunity Act.