Advertisement Headline

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

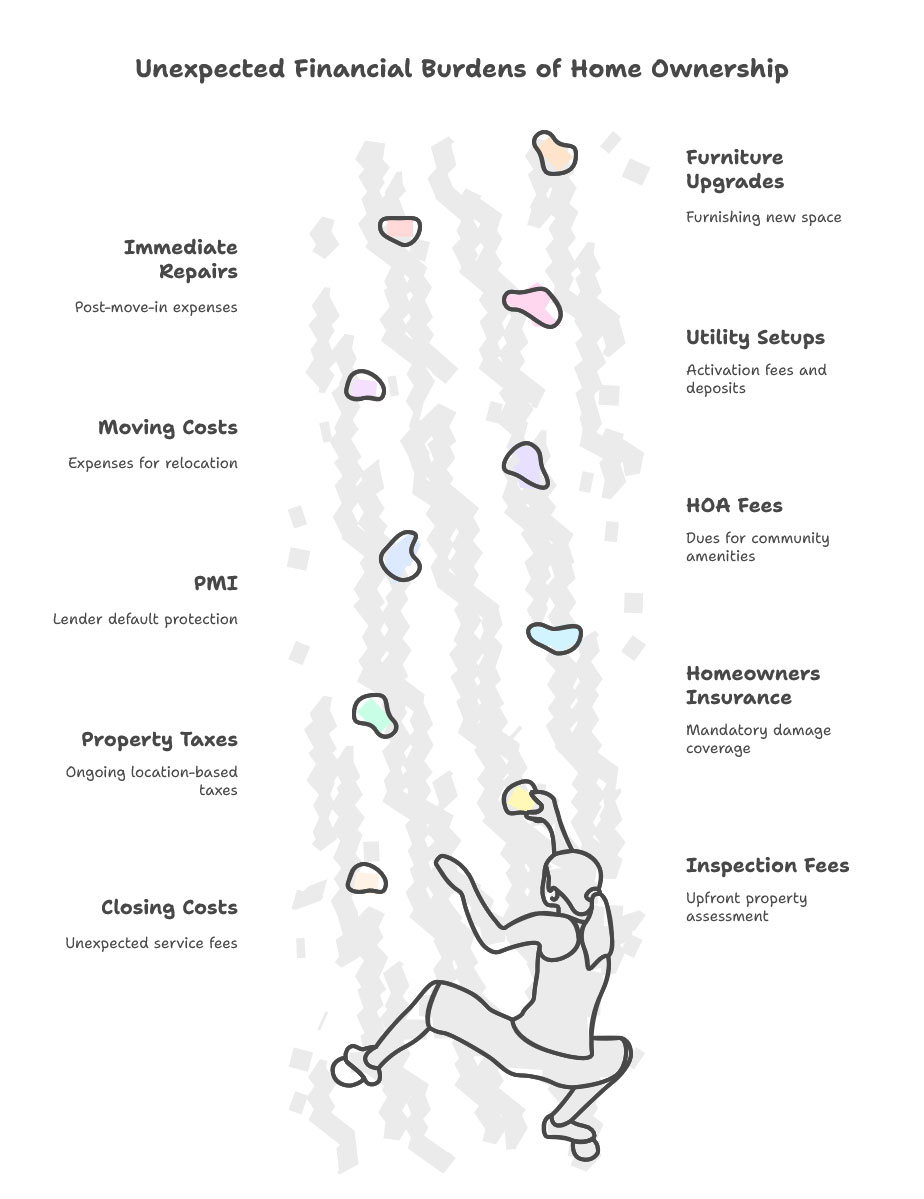

For the vast majority of people, home ownership represents the single biggest purchase they’ll ever make. While you likely know that a down payment and closing costs will be in order, along with any monthly mortgage, there are many other hidden fees that often take first-time buyers by surprise.

If you’re unprepared, these expenses can put a strain on your budget and transform your dream home into a financial nightmare. So you won’t get blindsided, here are the most common hidden costs of buying a home that no one tells you about.

Most buyers know to expect a down payment at the start of the home-buying process; but closing costs often make themselves known in the form of sticker shock. These fees cover services like:

Budget for 2–5% closing costs Based on the purchase price of your home, you’ll have to budget for an estimated 2 – 5% in closing costs. On a home that costs you $300,000, we’re talking about $6,000–$15,000.

A home inspection will reveal any issues you’ll want resolved, and a lender may require an appraisal to help confirm the property’s value. Combined, these can cost $500–$1,000 together (upfront). It’s money well spent, but a payment that many buyers fail to budget for.

The ongoing cost of property taxes varies based on the location in which you reside. Certain states or counties have relatively high tax rates, and many lenders require that you escrow the taxes into your monthly mortgage payment. This can add a lot to your monthly cost.

Lenders will insist that the home be insured before settlement, and you’ll owe the first year’s premium in advance. Policies cover damage to your home, from the peril of a fire, theft and storm exposure ― and so much more. This costs an average of $1,500–$2,000 per year — but could be significantly higher depending on where you live and what your coverage is.

If you put down under 20 percent, the majority of lenders will require PMI. This is an additional monthly expense and will provide the lender protection if you go into default. PMI can cost between 0.3% and 1.5% of your loan balance each year, depending on how much you put down, and could add hundreds of dollars a month to your mortgage payments.

If your new residence is in an area governed by a homeowners association (HOA), you’ll have monthly or annual dues to pay. Fees fluctuate widely, from $50 to more than $500 a month and can go up or down depending on amenity levels, such as pools, gyms and landscaping services.

Whether you hire professionals, or just rent a truck, moving isn’t free. They can vary from a few hundred dollars for local moves and more than a thousand for long-distance moves.

You will need to establish utilities, like electricity, gas, water and internet. Before a new user even streams their first YouTube video or gets “Squid Game” addicted on Netflix, providers typically add activation fees and deposits — which can tally quickly.

And even if you move in problem-free, there are immediate expenses you’ll inevitably accrue after moving in (replacing locks, repairing minor plumbing problems, purchasing new appliances). The continuous maintenance that comes with homeownership — usually about 1-3% of a home’s value each year.

The majority of buyers forget to factor in the cost of furnishing and making their new space their own. All of those things cost money, which can add up fast when you start buying curtains and rugs and couches, and outdoor furniture.

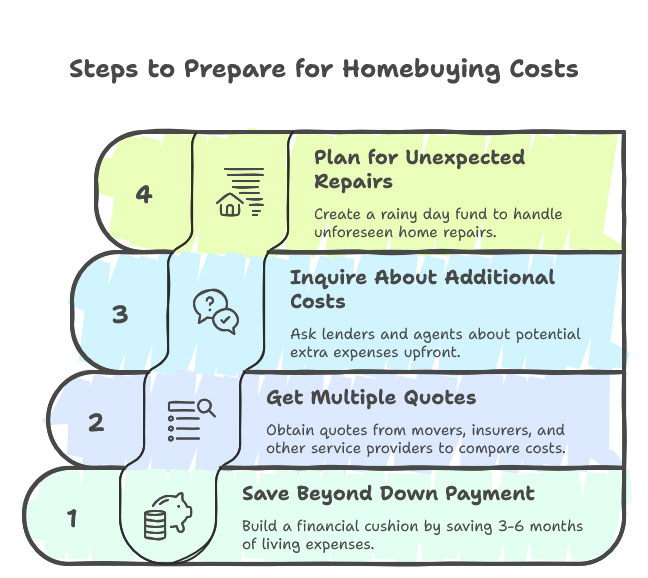

To avoid being stretched too thin, slip a cushion into your homebuying budget:

Purchasing a home can be thrilling, but it’s important to look beyond the purchase price and mortgage payment. And hidden costs, like insurance, taxes, repairs and moving expenses can easily mount. Planning ahead will allow you to relish your new home without overextending yourself financially.

At Monalending, we want to make sure that buyers are aware of the many aspects of owning a home. Our crew is there every step of the way, offering up to date recommendations for everything from loan choices to budgeting tips that will keep you financially prepared when those keys are in your hand.

Thinking about buying a home? Contact Monalending today for personalized advice on first-time and repeat purchases.

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

For many of us, purchasing a home will be the single most important investment decision we will ever…

Purchasing your first home is a big deal — but all that excitement can feel daunting if you…

For the vast majority of people, home ownership represents the single biggest purchase they’ll ever make. While you…

We are an Equal Housing Lender. we do business in accordance with the Federal Fair Housing Law and the Equal Credit Opportunity Act.