Advertisement Headline

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

The mortgage businss is at the cusp of a generational turnover. As Millennials move into their middle-age housing years, Generation Z — nearly everyone born between 1997 and 2012 — is starting to arrive. Young as they may be, their expectations and behavior are alreazdy reshaping real estate and lending’s future. For lenders, brokers and financial institutions to stay ahead of their game, they should understand the selling factors of this new crop of buyers.

Unlike the Millennial generation before them, Gen Z came of age in the long shadow of the 2008 financial crisis. They saw their parents burdened by mortgage debt and economic instability. As a result, they are often more risk-averse borrowers and wary of long-term commitments such as 30-year mortgages. They are also focused on shorter duration loans, flexible payback schedules and transparent lending practices.

Gen Z is also extremely debt-averse. Many come with student loans and are afraid to take on too much debt. That creates a need for affordability tools, down payment assistance and innovative products to help people buy when they’re confronting high housing costs that outstrip their more modest early-career incomes.

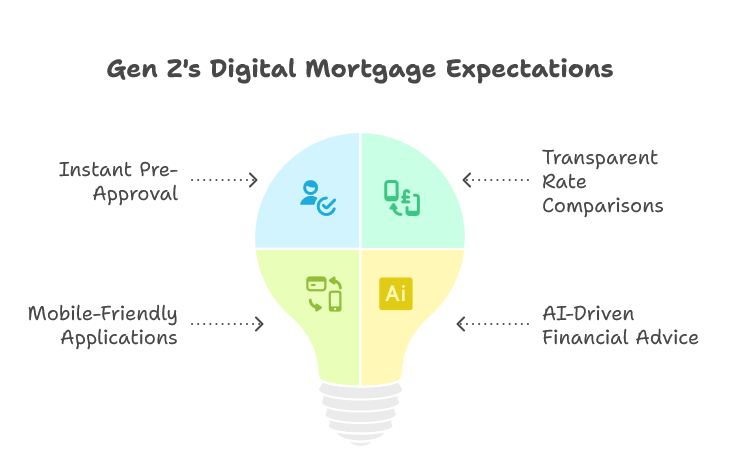

Digital-first is, as they say, default for Gen Z. They want the mortgage application process to feel just as easy as ordering from a food delivery service or using a mobile payment app. Features such as:

ain’t “extras” at all for this generation; they are necessities. For lenders that cannot offer seamless, tech-driven experiences, they stand to lose Gen Z customers to competitors who can deliver on these expectations.

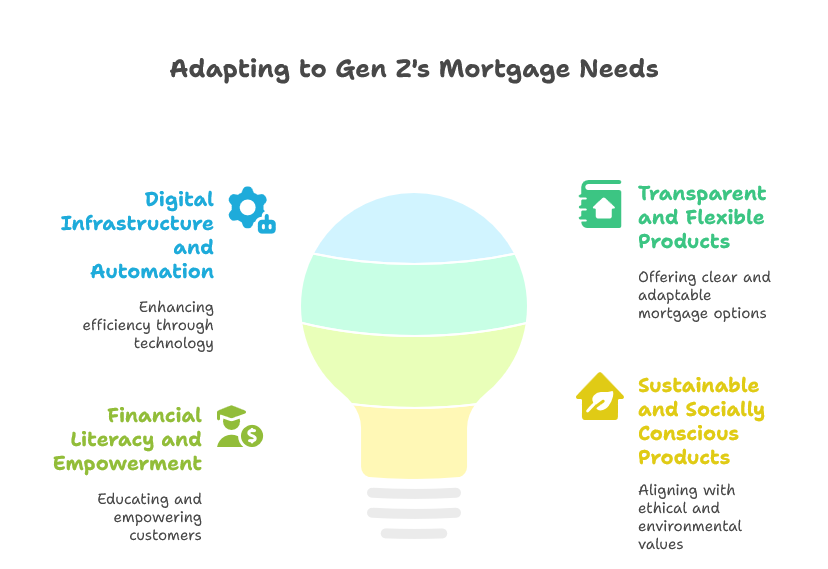

Values & sustainability: A defining point about Gen Z is their values and commitment toward sustainabililty. Many pine for homes with energy-efficient technology and are increasingly drawn to “green mortgages” that reward environmentally responsible choices. They’re also more socially minded, many seeking to work for institutions that stand out for their values of inclusivity, transparency and social responsibility.

Gen Z doesn’t want to be and feel like they’re getting into debt; they want to feel empowered. That means a mutually transactional relationship will not suffice, and the mortgage process needs to instead offer a collaborative educational experience. Interactive budgeting calculators, educational information around building credit history and personalized digital advice is going to be key for gaining their trust in tools and services.

In order to cater Gen Z’s needs, the mortgage industry needs to:

Make no mistake, Gen Z is not simply the next wave of homebuyers – they are ushering in a significant shift in how financial services will be provided and consumed. The mortgage professionals who pivot soonest to technology, transparency and value-based lending will be the ones capitalizing in this new age of homeownership.

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

For many of us, purchasing a home will be the single most important investment decision we will ever…

Purchasing your first home is a big deal — but all that excitement can feel daunting if you…

For the vast majority of people, home ownership represents the single biggest purchase they’ll ever make. While you…

We are an Equal Housing Lender. we do business in accordance with the Federal Fair Housing Law and the Equal Credit Opportunity Act.