Advertisement Headline

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

The single biggest decision you’ll make when purchasing a mortgage is whether to opt for a fixed type or a variable type. That decision matters because it can affect more than just your monthly payments; it could also help determine the total cost of your mortgage over its lifetime.

Should you lock in the stability of a fixed rate, or enjoy the potential savings from a variable rate? The answer is it depends; it ultimately will depend on many factors, including your financial circumstance, level of risk tolerance and long-term goals.

In this piece, we’ll explain the differences between changeless and adjustable mortgage rates, lay out the pros and cons of each, while also detailing critical factors that should help guide your decision on which option is most appropriate for you.

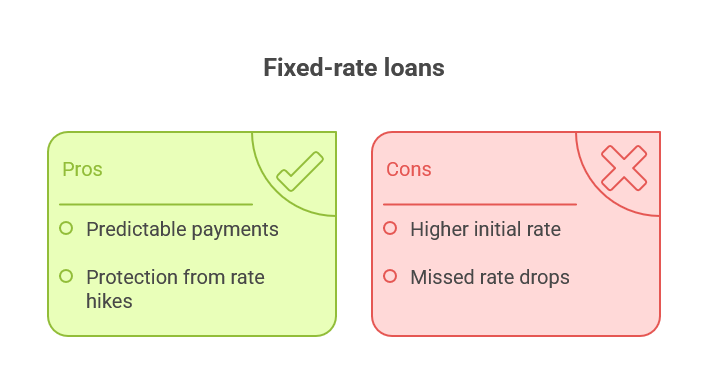

A fixed rate simply means that the interest rate (and thus your monthly payments) remains the same for the duration of the loan – be it 3, 5, or even 10 years.

If you’re a risk-averse borrower who likes to know exactly what your home payment will be each month, this option is for you.

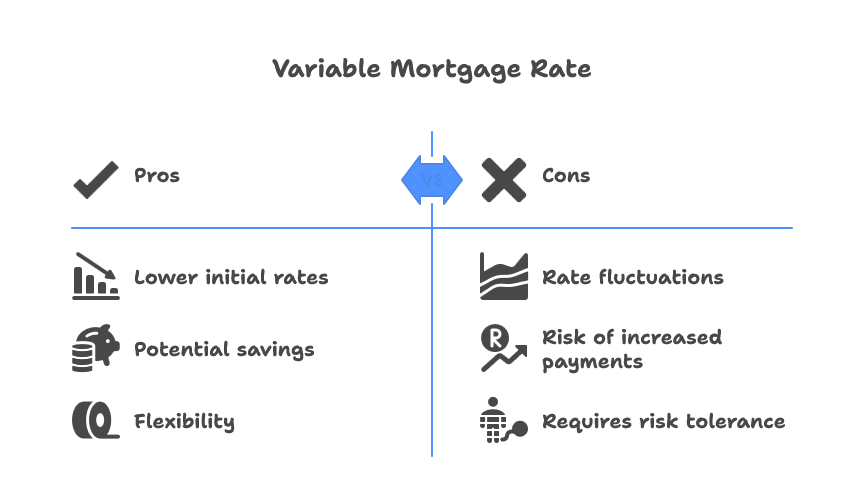

Interest on a variable mortgage rate (the type of interest rate that most Canadians have for their mortgage) is linked to the prime rate, though this fluctuates with changes in Bank of Canada policy rates.

It is an option that can make sense for borrowers who are willing to accept a little risk and hassle in return for potential savings.

✅ Advantages:

❌ Disadvantages:

✅ Advantages:

❌ Disadvantages:

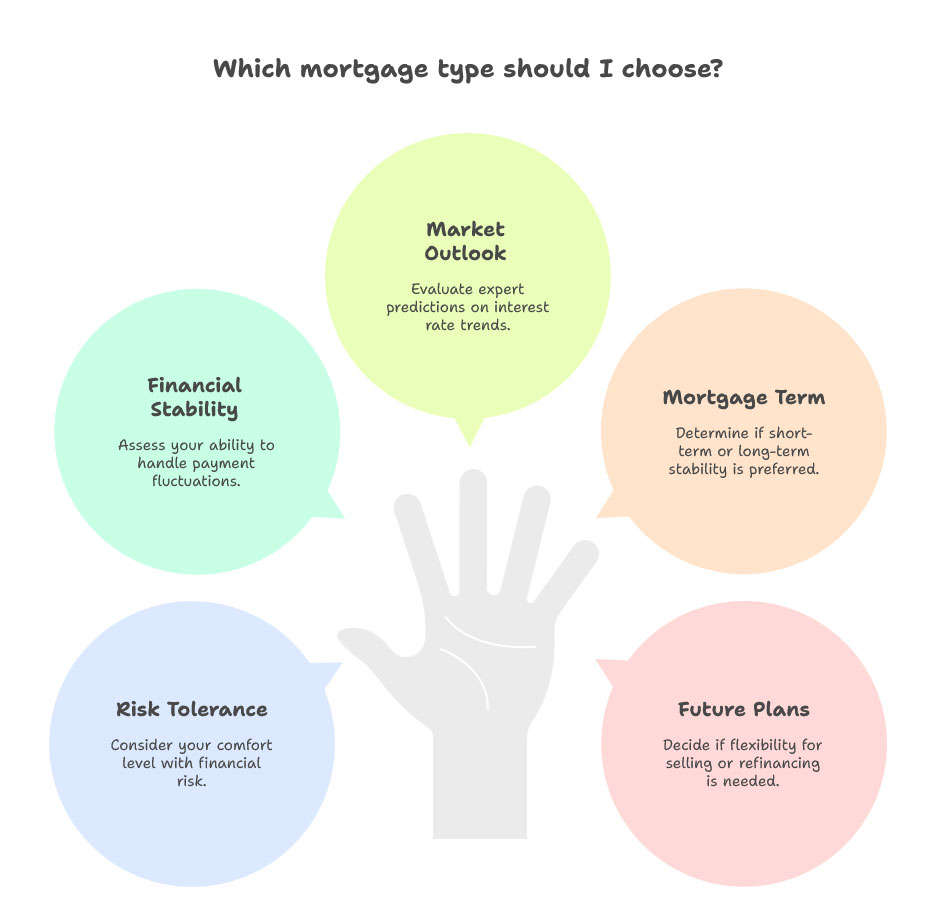

Do you want to know exactly what your loan will look like, or are you okay with a little financial risk?

Do you have budgetary space to absorb possible payment hikes?

Do experts expect rates to rise or fall in the next week?

Short-term borrowers may find more upside in variable rates, while long-term borrowers might increasingly relish the fixed stability.

If it’s likely you will be selling your home or refinancing before then, a variable mortgage may offer you more flexibility with less of a penalty.

Certain lenders have hybrid mortgages that offer a mash-up of fixed and variable rates. For instance, half of your mortgage may be fixed and the other half variable. This is a stability with adaptability tradeoff.

Scenario 1: The Safety-Seeker

A first-time homebuyer on a tight budget, Sarah is not (yet) one of those people. She opts for a 30-year, fixed-rate mortgage to ensure her payments never rise.

Scenario 2: The Risk-Taker

Daniel is stable with steady income and some savings. He opts for an adjustable-rate mortgage, believing he can cope with short-term uncertainties while possibly pocketing some money along the road.

Yes, almost all lenders allow you to lock into a fixed rate at any time.

Fixed rates can be a safer option for first-time buyers because they make budgeting easier.

Your payments on an adjustable mortgage might go up. Some lenders recalculate the payment; others stretch out the amortization.

Yes. Incurring penalties to break a fixed mortgage can run in the thousands as borrowers will typically be charged interest rate differential (IRD), instead variable mortgages charge only 3 months’ interest.

Deciding between a fixed and variable mortgage rate isn’t about finding the “right” answer for you — it’s about discovering what makes sense for you.

In the majority of cases, the best decision is made following exorel sapling with a mortgage broker who can offer individual advice and access to hundreds of lenders.

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

For many of us, purchasing a home will be the single most important investment decision we will ever…

Purchasing your first home is a big deal — but all that excitement can feel daunting if you…

For the vast majority of people, home ownership represents the single biggest purchase they’ll ever make. While you…

We are an Equal Housing Lender. we do business in accordance with the Federal Fair Housing Law and the Equal Credit Opportunity Act.