Advertisement Headline

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

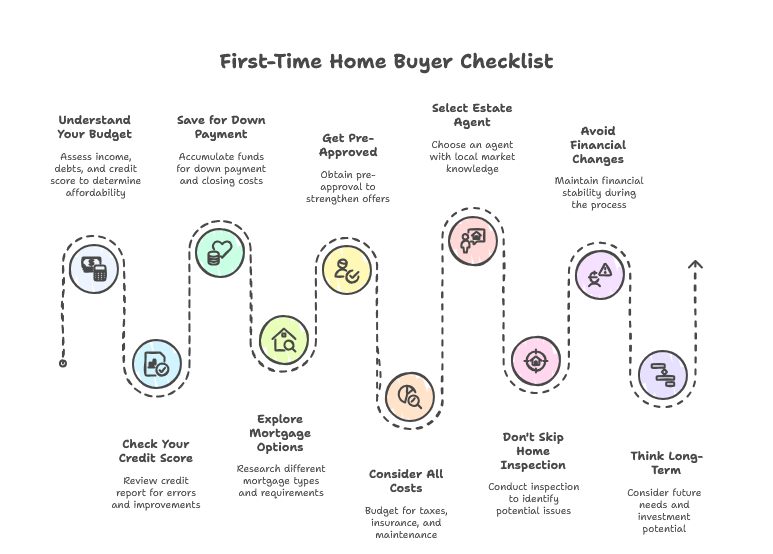

Purchasing your first home is a big deal — but all that excitement can feel daunting if you don’t know the ins and outs of buying a home. From saving for a down payment to navigating mortgage options, there are many moving parts. If the plan is in place, it can be a lot easier and less stressful along the way.

We want to help: We’ve compiled a first-time home buyer checklist of 10 things to take every step of the way when buying your first home.

Before you begin to web-surf listings, scrutinize your finances. They will consider your income, debts, assets and credit score. One rule of thumb is to spend no more than 28% of your gross monthly income on housing expenses, including your mortgage, property taxes and insurance.

Knowing your budget is a good tool to prevent you from falling in love with homes priced beyond what you can afford.

Your credit score will certainly be a factor when you are trying to get approved for a mortgage (not to mention getting approved quickly and easily) and your interest rate, the two things that can make/break the overall cost of what you pay. Higher scores are typically associated with lower rates. Pull your free credit report and look for errors, as well as measures to improve your score if necessary, before you apply.

So many first time home buyers only think about the down payment — but you will also likely need money for closing costs, which usually run anywhere between 2–5% of the price of your new home. Though some programs will let you purchase with as little as 3 percent down, the more you can save, the broader your loan options may be.

Mortgages aren’t all created equal. Here are a few common choices for first-timers:

The right loan for you will depend on your financial profile and your long-term goals.

A mortgage pre-approval demonstrates to sellers that you’re serious, and it gives you a more accurate picture of what homes are in your price range. It is more than just a rough estimate — it means having a lender look at your income, assets and credit. How to make it stronger This step can drastically strengthen your offer in competitive markets.

The monthly mortgage payment is only a fraction of the picture. Also budget for:

Having a realistic sense of these expenses will allow you to avoid financial surprises down the line.

A good agent can make a world of difference for first-time buyers. Find someone who knows the local market, can accommodate your budget and has experience walking buyers through the process. A good agent will fight for you, negotiate well on your behalf and prevent you from making costly mistakes.

Even if a home appears perfect, always have a professional inspection done. Inspectors can uncover unseen problems, such as foundation cracks, plumbing issues or roof damage. This provides leverage to negotiate repairs — or back out of the purchase if there are more significant problems.

After Pre-Approval: Don’t make large financial changes before closing. Don’t open new credit cards, purchase a car or take large amounts of money from savings. Lenders are going to validate your financials again before final approval, and major changes can put your mortgage at risk.

Buying your first home is more than a matter of meeting today’s needs — it’s an investment in your future. But think about how long you plan to live in the home, its re-sale potential and how well it aligns with your lifestyle goals.

Owning a home for the first time is a life-changing milestone, but preparation is key. With the help of this checklist, you’ll be armed and ready to make informed choices across your home buying journey so that you can steer clear of common mistakes — and a smoother process towards homeownership.

First time buyer advice from Monalending Here at Monalending we helping first-time buyers all the way. Beginning with investigating mortgage options to preparing for closing, our we are here to assist you in reaching your goal of home ownership.

Ready to start your journey? Contact Monalending for their help today and let us give you confidence in your first steps towards home ownership.

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

For many of us, purchasing a home will be the single most important investment decision we will ever…

Purchasing your first home is a big deal — but all that excitement can feel daunting if you…

For the vast majority of people, home ownership represents the single biggest purchase they’ll ever make. While you…

We are an Equal Housing Lender. we do business in accordance with the Federal Fair Housing Law and the Equal Credit Opportunity Act.