Advertisement Headline

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

When you sign onto a mortgage, the terms are locked in for a set period —say 3, 5 or even 10 years. But the universe doesn’t always cooperate with those timelines. Whether it’s a job change, growing family or changing financial objectives, you might even ask yourself: Should I break my mortgage?

At its most generic, breaking your mortgage refers to ending your current contract before the term expires. This may sound like a line that can lead to new opportunities, but it usually does not come for free. Here’s an overview of the pros and cons so you can decide if it’s the right thing for you.

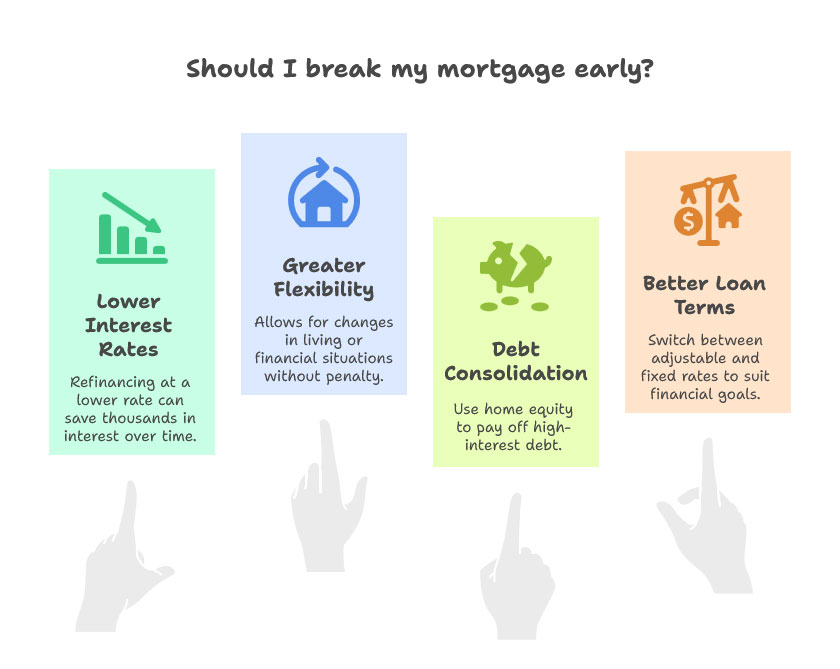

If market rates have gone down since you closed your mortgage, breaking the contract could enable you to refinance at a lower rate. Even the slightest decrease — maybe from 6.5 percent to 5.5 percent or lower — can save you thousands of dollars in interest over time.

Life changes quickly. Perhaps you have a new job in another city or are looking to upgrade to a larger home. Your mortgage comes with conditions that allow you to break your term and move, sell or change your financing to suit your needs.

By breaking or refinancing, you can tap your home equity to pay off high-interest debt. This can streamline your finances and reduce the amount of interest you end up paying.

Maybe you initially went with an adjustable-rate mortgage (ARM) when you purchased and now desire the predictability of a fixed rate — or vice versa. When you break your mortgage, you get an opportunity to obtain terms that are more suitable for your financial goals.

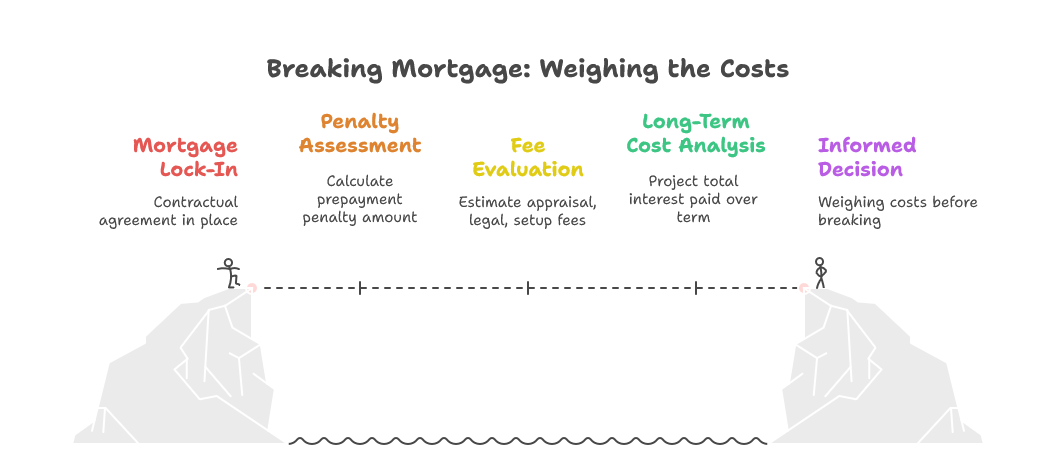

Many impose a penalty if you break your mortgage before the end of the term. Depending on the terms of your contract and how much you have left to pay, that could range from a few months’ worth of interest to thousands of dollars.

In addition to penalties, there could be appraisal fees, legal costs and new mortgage setup fees. These can erode what if any savings refinancing would bring.

If you break your mortgage for a lower rate and take an extended term, you may end up paying more interest over the life of the loan — even if it’s at a lower rate.

Walking away is not as simple a process to break the mortgage. It may require paper work, some calculations and negotiations that would take time and effort.

If the penalties appear too severe, you may have other alternatives:

It can be a genius financial move to break your mortgage — but you’ll need to read the fine print first. Savings should be weighed against penalties and fees. For others, it’s an opportunity to lock in a lower rate, consolidate debt or add flexibility. For still others, the negatives may outweigh the benefits.

At Monalending, we also aid homeowners in the calculation of the sums so that they have all their choices by hand. We want to make sure that you’re picking the path that is actually going to be in service of your long-term financial health.

Thinking about breaking your mortgage? Get in touch with Monalending today for a customized evaluation to see if it’s the right move for you.

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

For many of us, purchasing a home will be the single most important investment decision we will ever…

Purchasing your first home is a big deal — but all that excitement can feel daunting if you…

For the vast majority of people, home ownership represents the single biggest purchase they’ll ever make. While you…

We are an Equal Housing Lender. we do business in accordance with the Federal Fair Housing Law and the Equal Credit Opportunity Act.