Advertisement Headline

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

A mortgage is also the largest financial commitment that most homeowners ever make. And since terms of a mortgage are generally only for a few years — frequently three to five — you’ll almost certainly have multiple chances to renew before your home is paid off. But here’s the million-dollar question: When is the right time to renew your mortgage?

By locking in a good rate today instead of re-upping out of habit, you can end up saving substantial amount on interest payments, and it could also make your loan much more flexible and keep you financially secure.

A mortgage renewal is when your term comes to an end and you still have a balance owing. You don’t pay back the loan in full — instead, you renegotiate a new term with your current lender or a different one.

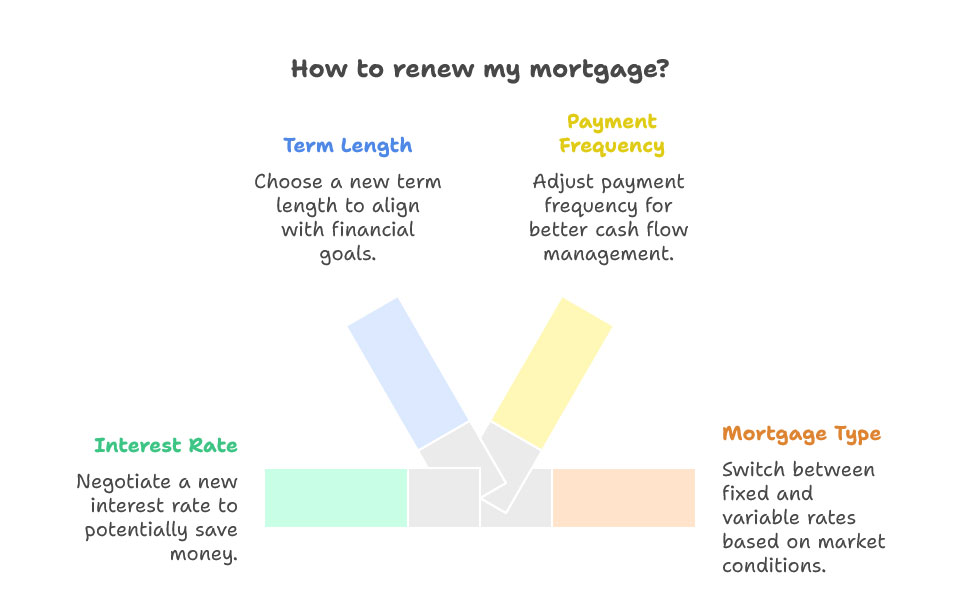

These are the biggies you may want to update during renewal:

This is not simply a paperwork drill — it’s an occasion to reconsider your financial goals.

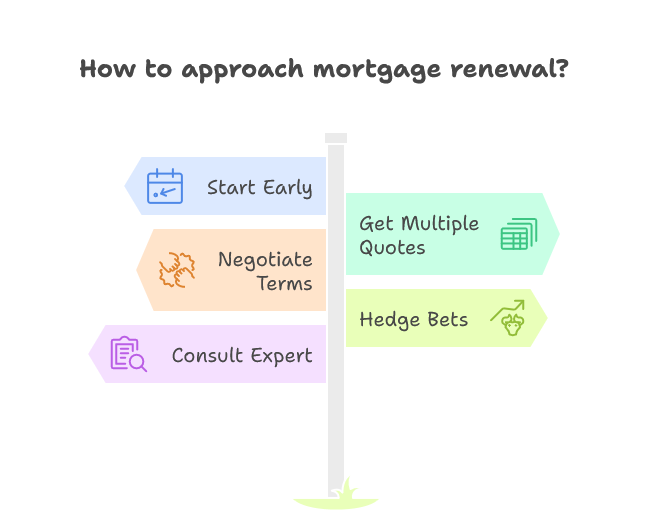

The majority of lenders are going to send a renewal notice 4–6 months before your term expires. It’s now time for you to begin shopping around and weighing offers. Don’t leave it until the last minute — renewing early is your friend.

If rates have gone down since you took out your mortgage, renewing early (or breaking your current term entirely in some cases) may be a way to capture savings. A lower rate indicates lower monthly payments and less paid in interest over the life of the loan.

Life is not one set moment after another. If you’ve had changes to your income, expenses or goals, renewal is the ideal opportunity to change up your mortgage. For example:

Renewal allows you the opportunity to change lenders without penalty (as opposed to refinancing mid-term, which could incur fees). If you’re unhappy with service, rates or offerings, renewing your policy is an opportunity to see what else is available.

Renewal is what we’re talking about, and it’s not all about rates, but also flexibility. Perhaps you’d like prepayment privileges, the ability to make lump-sum payments or a more frequent payment schedule. and that renewal is the perfect time to make those changes.

Early renewal can be appealing, but it may not always be a good idea:

The “right time” to renew your mortgage isn’t just a matter of calendar dates, but also about timing your loan with your financial requirements and market circumstances. So whether you want to save money, pay off your mortgage faster or simply give yourself some flexibility, timing a renewal right can put you ahead.

We at Monalending provide useful information for homeowners to consider before it’s time for renewal. You can turn your mortgage renewal into a financial advantage with the right strategy.

Is your mortgage maturing soon? Your are just a call away to Monalending, talk and secure best deal.

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

For many of us, purchasing a home will be the single most important investment decision we will ever…

Purchasing your first home is a big deal — but all that excitement can feel daunting if you…

For the vast majority of people, home ownership represents the single biggest purchase they’ll ever make. While you…

We are an Equal Housing Lender. we do business in accordance with the Federal Fair Housing Law and the Equal Credit Opportunity Act.