Advertisement Headline

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

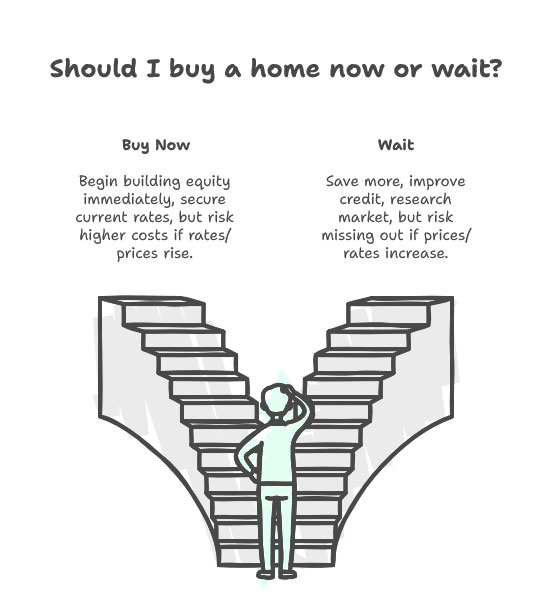

Determining when to purchase your first home is one of the largest financial decisions that you will ever make. With increasing home prices, variable interest rates and no clear forecast for the market, it’s common to ask the question: “Should I buy now or wait?”

The reality is, there isn’t one size that fits all. As with any other financial decision, the best time to buy a home is when you’re good and ready. This guide will help you navigate the key things to know so you can make the best decision for your specific situation.

Before diving into market dynamics, ask yourself: Am I ready to buy a home financially? Consider:

Job Stability: Consistent income can mean an easier time qualifying for — and paying a mortgage.

If you are financially solvent, you could be prepared now. If that’s not the case, consider holding off on a stronger-than-necessary financial position so you can succeed at some point in the future.

Home affordability is greatly influenced by mortgage interest rates. It can make or break your budget: A slight difference in interest rates could shift a monthly payment by hundreds of dollars.

It’s worth remembering, however, that nobody can predict rates with precision. Some buyers opt to purchase now and refinance if rates fall.

Home prices fluctuate depending on where you live and market conditions.

Look up some local market data, or reach out to a real estate agent, to see what’s trending in your market.

Ask yourself: What am I looking for in a home right now? Common reasons include:

If you anticipate staying at your destination for a minimum of 5–7 years, buying now can be a great idea. If the stability of your future is less clear — think, for instance, that you may have to relocate for a job in a few years – renting may prove safer for now.

Here’s the reality:

Both aren’t ideal — it’s a matter of which is best for your wallet and lifestyle at this point.

If you believe now that it is time to buy, here are ways to maximize your position:

If patience does seem like the more prudent course, spend your time wisely.

The choice to make a purchase now or hold off depends on finding the right balance between financial preparedness and market conditions. No one can perfectly predict the housing market, but you can control your own readiness.

At Monalending, we assist first-time buyers in comparing their options while finding them a great path forward. You may be ready to buy today, or just preparing for the future. Either way we will work with you to understand your dreams and find a plan that fits your lifestyle, goals and budget.

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

For many of us, purchasing a home will be the single most important investment decision we will ever…

Purchasing your first home is a big deal — but all that excitement can feel daunting if you…

For the vast majority of people, home ownership represents the single biggest purchase they’ll ever make. While you…

We are an Equal Housing Lender. we do business in accordance with the Federal Fair Housing Law and the Equal Credit Opportunity Act.