Advertisement Headline

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

Your mortgage rate is a critical factor in how much you can borrow or spend on your home through the years. Even half of a percentage point can cost tens of thousands of dollars in interest over the life of your loan.

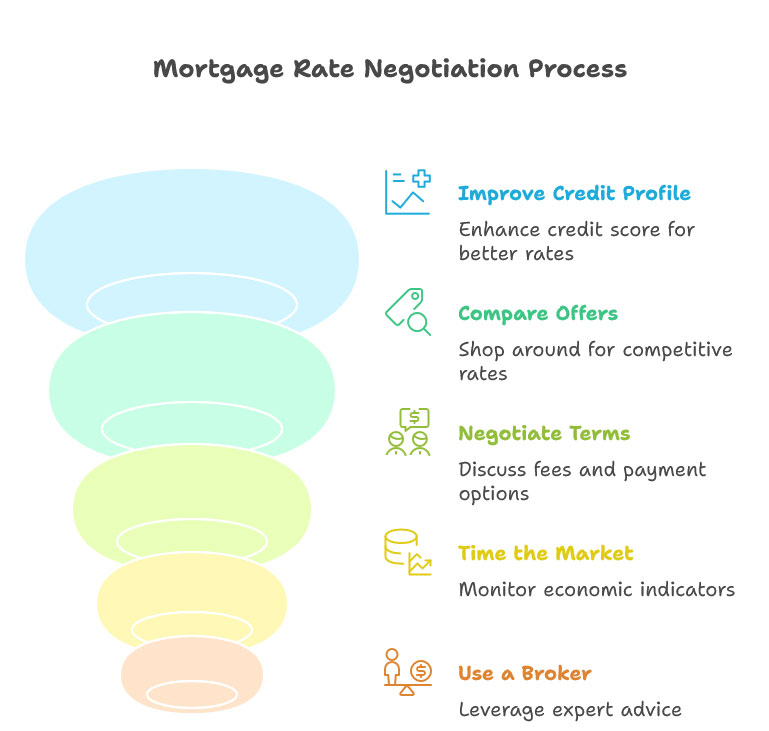

The good news? Mortgage rates can fluctuate, even after you first settle on a rate with your lender. With the proper approach, however, you can negotiate a better deal and save big. Here are five time-tested negotiation tips to help you get the best mortgage rate.

Lenders rely on your credit score to determine how risky you are to lend to. The higher the score, in general, the lower the rate. Before applying, take time to:

Even a small increase in your score can help you negotiate from a position of more strength.

Never accept the first admission offer you get. Shop around with several lenders, including banks, credit unions and mortgage brokers.

When you have a few offers, you can use them as leverage. If one lender offers a lower rate, ask another whether it can match or beat it. Competition works in your favor.

The interest rate matters, but it isn’t the only negotiable point. Consider the wider picture, such as:

In other cases, a lender might not lower the rate but could waive fees or improve terms — that still puts much-needed cash in your pocket.

Mortgage rates are sensitive to market conditions. Timing when you lock in your rate can make a big difference.

Another factor to consider is that if rates are anticipated to increase, acting sooner may save you thousands.

It’s scary to negotiate with lenders, especially if you don’t know the jargon used in the industry. Here are some ways in which a mortgage broker or advisor can help:

Their knowledge of the law can give you an edge, and even make sure that you aren’t leaving any money on the table.

The idea of negotiating for a mortgage rate can be pretty intimidating, however if you are prepared and persistent the effort can yield big results in terms of your long-term financial health. By working on your credit, comparison-shopping and being strategic about timing and terms, you’ll be well placed to save a lot of money in the long run.

At Monalending, we specialize in helping homebuyers and homeowners attain the lowest mortgage rates available. Our team is here to help you, we can walk you through the process, present offers and negotiate saving you time and money throughout your search for the perfect home.

Ready to lock the best mortgage rate? Contact Monalending to negotiate on your behalf today.

Curabitur vel gravida neque. Sed non imperdiet elit. Maecenas in pretium dolor, sit amet rutrum.

For many of us, purchasing a home will be the single most important investment decision we will ever…

Purchasing your first home is a big deal — but all that excitement can feel daunting if you…

For the vast majority of people, home ownership represents the single biggest purchase they’ll ever make. While you…

We are an Equal Housing Lender. we do business in accordance with the Federal Fair Housing Law and the Equal Credit Opportunity Act.